Cam Anderson, CEO and Director of Silverhall

After 2020, the question on everyone’s mind was how did the property market finish in 2020?

The answer: Australian property values finished 3.0% higher over 2020. Now keen property enthusiasts, homeowners and investors have already begun to make moves and the forecasts for 2021 mean they are on the right side of things.

“Housing values continued to rise through the first month of 2021 with CoreLogic’s national home value index up 0.9% over the month. The January movement takes Australian home values to a fresh record high. Housing values have surpassed pre-COVID levels by 1.0%, and the index is 0.7% higher than the previous September 2017 peak.” (Tim Lawless )

Corelogic's Quarterly Economic Review in December showed that the downturn was minor and Property prices are on the upswing, a trend that has continued in 2021. Head of research Eliza Owen surmises “There are numerous factors which have contributed to the prevention of a larger downturn in dwelling values including the institutional, coordinated response to the pandemic, which have seen low borrowing costs, added incentives for first home buyers and the extension of mortgage repayment deferrals limiting forced sales.”

So, what are the main factors driving growth, according to all the experts across the country?

Important Research Note: Location is Important

Whilst the term ‘Australian Property Market’ is familiar to everyone, it is largely irrelevant when really, we need to know what is happening in more specific locations. Example, the Sydney CBD is not the same property market as the NSW Central Coast. However, you will hear me refer to the term Australian Property Market as a macro guide. It is very important to dig down deeper to what is driving changes in property values in a particular market. So over to the factors affecting property growth right now:

Supply and Demand

Supply & Demand – it has not changed since time immemorial and times like these highlights this beneficial opportunity for the property sector.

This is one of the fundamental factors driving growth in any property market, that Silverhall will always guide our clients back to. “With housing activity continuing to rise at above average levels [and] listing numbers remaining well below average, the natural consequence is upward pressure on housing prices.” (Tim Lawless, CoreLogic Feb 2021).

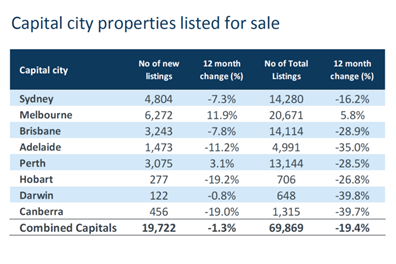

Buyer demand is meeting with finding limited supply. This is contributing to upward pressure on dwelling prices. Total dwelling stock on the market finished about 20% lower at the end of 2020 than in the equivalent period of 2019. 7 of our 8 capital cities having significantly less properties for sale than 12 months ago (CoreLogic). It goes without saying, strong demand at a time of limited supply must lead to property price growth.

Certain markets were already experiencing an undersupply of property in March 2020. An impact of Covid-19 hitting Australia was financial institutions largely ceasing lending to new property developments or substantially increasing the pre-conditions for projects to commence, such as presales. In many cases both. This only further exacerbated a shortage of property in particular areas. Combined with the migration of people from Covid-19 impacted areas, to regional areas, has brought about predictable results: A real strengthening of prices in the market and therefore capital appreciation of property.

Vacancy Rates

Directly impacted by supply and demand factors, vacancy rates in many key areas are low with an influx of new residents and lifestyle. By way of Example, certain Silverhall selected suburbs below represent a snapshot of the impact the last year has had on many suburbs we identified, with already low vacancy rates.

Government Incentives and Institutional Coordination

These have been a leverage point for Governments in times of economic downturns. Example, NRAS was established at the time of the GFC. Here are the key ones helping to influence demand for property since Covid

• HomeBuilder Grant

• First Home Loan Deposit Scheme

• State specific First Homeowners Grants

• First home Concessions on Stamp duty

Government stimulus programs and the rise of owner-occupier purchases over 2020 may have contributed to a strong uplift in detatched house approvals over the year relative to units (CoreLogic)

• Owner occupiers led a recovery in housing finance lent for the purchase of property over the year, aided by rapid growth in the first home buyer segment, which was up 35.1% in the 12 months to October. (CoreLogic)

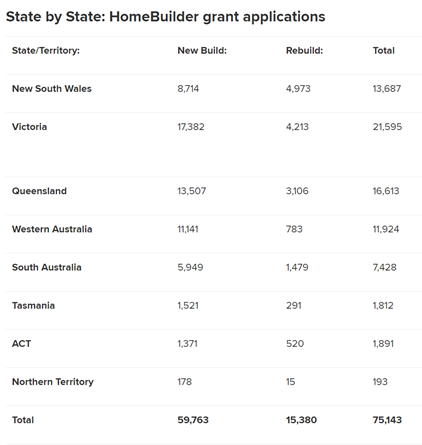

• New data released shows as of December 31, 2020, a total of 75,143 applications for the Home Builder Grant had been received. The original estimates were 20,000 new builds and 7,000 major renovations

Regional Growth

Covid has been a significant influencer on particular regional property markets. People moving away from CBD’s and built-up areas due to the impact of Covid has increased the demand for property in markets already very tight on supply.

CBD Movement - Activity in the Australia’s Capital City CBDs during January 2021 shows movement levels in the first half of the month are well down on the same period a year ago – by as much as 72% in the Melbourne CBD and 66% in Sydney CBD (Roy Morgan Research 2021).

Working From Home - 4.3 million people (32% of working Australians) have been ‘working from home’ (Roy Morgan Research). Before the arrangements changes Covid-19 brought about, this was averaging at 20% in capital cities. In NSW the numbers were higher for WFH, reaching up to 39 % during the last year and Qld following this rising to 27%. The WFH trend has been more pronounced in the Metropolitan areas than outside.

Benefiting from remote working arrangements, internal migration, closed borders and better affordability, regional home prices climbed by 1.58 per cent in January after December’s 1.63 per cent gain – the biggest lift in 17 years. Prices surged 7.9 per cent in the year to January – the strongest annual growth rate in 16 years. (CommSec's Ryan Felsman)

There has been a big move to regional areas and house prices are reflecting this change for lifestyle, space and the rise in work from home arrangements 2020 fostered. Industries hit hard by the changes of Covid-19 are not the primary economic forces in these areas. In fact, Covid-19 has increased work opportunities with expansion of certain sectors, including logistics and warehousing, transport, residential construction.

“Better housing affordability, an opportunity for a lifestyle upgrade and lower density housing options are other factors that might be contributing to this trend, along with the newfound popularity of remote working arrangements.” (Tim Lawless)

The key regional market Silverhall has been investing in for several years has continued its rise, especially towards the end of 2020. NSW Central Coast is the leading regional market in Australia. Its proximity to Sydney and key investment commitments in infrastructure of $4 billion prior to 2020 have set it up as a prime location for property and lifestyle.

Additionally, Silverhall selected areas north of the Central Coast and Greater Brisbane are also benefitting:

• Maitland and Cessnock

• Logan,

• Moreton Bay

• Ipswich Local Government Areas

So, what is driving property growth in and around Australia?

Property growth is happening in Australia, even after the unprecedented year that was 2020. However, it’s not all of Australia, but more responsibility and accurately, property growth is happening in some areas of Australia.

Lower listings equals lower supply, creating an unavoidable knock on effect for demand and upward pressure on property prices. Population changes through internal migration, government incentives with lower costs of borrowing helping demand. It all helps in driving growth.

These simple attributes, knowing where to invest remains an important focus on the fundamentals for your property investment strategy. Add into this the rise in confidence and investor market reawakening, the rise in property price in 2021 looks well on its way.